Welcome to another price prediction post by Glancedoor.com, Here in this article we will provide complete information about Air Transport Services Group (ATSG) Stock along with ATSG Stock Forecast & Price Prediction 2025, 2030, 2040,2050

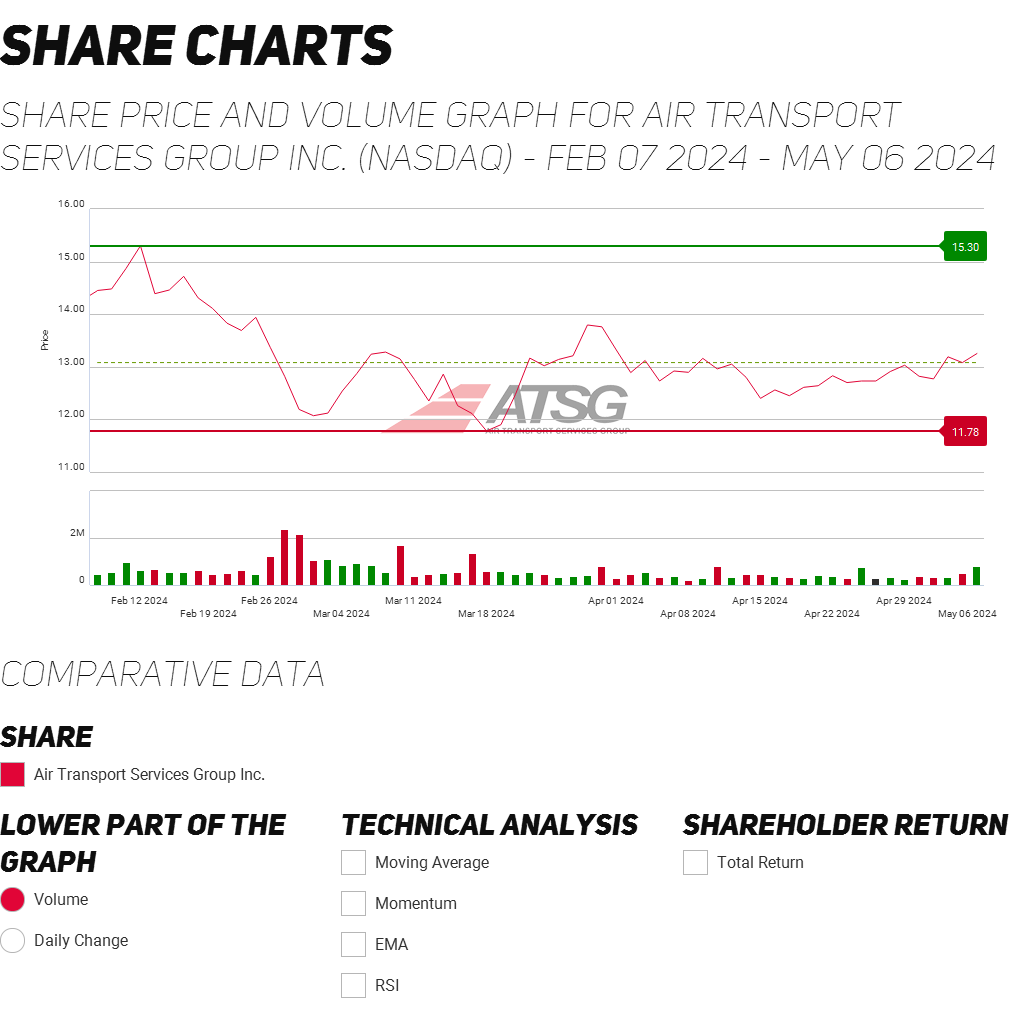

ATSG stock Current Status:

| Current Price | $ 12.92 |

| Volatility | 2.43% |

| 14-Day RSI | 53.20 |

| Sentiment | Bearish |

| Fear & Greed Index | 37 |

| Green Days | 18/30 |

| 200-Day SMA | $ 16.95 |

| 50-Day SMA | $ 12.81 |

Market analysis

Our analysis suggests Air Transport Services Group (ATSG) has room for growth. We forecast a price increase of 2.81%, reaching $13.25 per share by May 12th, 2024. However, technical indicators currently show a bearish sentiment, with the Fear & Greed Index at 37 (indicating fear). Despite this, ATSG has performed well recently, with 59% of the last 30 days in positive territory and a price volatility of only 2.44%. Considering the forecast and current discount to our prediction (2.73%), ATSG may be an attractive buying opportunity.

About Air Transport Services Group (ATSG)

Air Transport Services Group (ATSG) is a major player in the aviation industry, specializing in air cargo transportation. They cater to both domestic and international air carriers, as well as other companies seeking to outsource their air cargo needs. ATSG stands out as the world’s leading lessor of converted Boeing 767 freighter aircraft, achieved through their dedicated leasing division, Cargo Aircraft Management.

| Service | Description |

| Cargo Transportation | Provides air cargo transportation services for domestic and international air carriers, as well as companies outsourcing their air cargo needs. |

| Leasing | World’s largest lessor of converted Boeing 767 freighter aircraft through their subsidiary, Cargo Aircraft Management. |

| Passenger Services | Offers ACMI (Aircraft, Crew, Maintenance, and Insurance) and charter services for passengers. |

| Maintenance | Provides aircraft maintenance services through their subsidiary, Airborne Maintenance & Engineering Services. |

| Ground Services | Offers airport ground services through their subsidiary, LGSTX Services, ensuring smooth operations on the ground. |

| Support Services | Offers additional logistical support services related to cargo aircraft operations, potentially including services like cargo handling and freight forwarding. |

ATSG Reports First Quarter 2024 Results

ATSG Expands Operations in the Amazon Air Network

Source : – ATSG Interested in fisker stock? please follow the link

ATSG Stock Forecast & Price Prediction 2025, 2030, 2040,2050 – Long Term

| Year | Prediction | Change |

| 2025 | $ 13.88 | 10.30% |

| 2026 | $ 14.80 | 20.84% |

| 2027 | $ 17.35 | 33.51% |

| 2028 | $ 18.70 | 47.50% |

| 2029 | $ 20.80 | 62.93% |

| 2030 | $ 25.40 | 85.20% |

| 2040 | $ 35.70 | 90.20% |

Air Transport Services Group (ATSG) Stock Outlook for 2025

Here’s a breakdown of current analyst predictions and factors to consider regarding ATSG stock performance in 2025:

Predicted Price: Analysts currently estimate ATSG stock to reach around $15.27 by 2025. This prediction assumes a continuation of the company’s average growth rate over the past decade, translating to a potential increase of 12.39%.

Air Transport Services Group (ATSG) Stock Outlook for 2030

Potential 2030 Scenario:

Air Transport Services Group (ATSG) in relation to a 2030 prediction of $24.40:

- This prediction assumes ATSG maintains its current 10-year average growth rate, translating to an increase of approximately 81.30% from its current price.

Air Transport Services Group (ATSG) Stock Outlook for 2040

ATSG Stock Prediction for 2040: A Look Farther Ahead

Predicting stock prices for such a distant timeframe (2040) becomes even more challenging due to the vast number of variables that could come into play. However, we can explore some potential scenarios and considerations:

Possible 2040 Scenario:

- If ATSG maintains its current 10-year average growth rate consistently for the next 16 years, the stock price could theoretically reach much higher valuations, exceeding estimates for 2030. However, this scenario is highly unlikely due to the factors mentioned below.

Extreme Uncertainty in Long-Term Predictions:

- Exponential Change: Technological advancements over such a long period could revolutionize the air cargo industry. Drones, autonomous aircraft, or entirely new modes of transportation could drastically alter the landscape, making current growth models irrelevant.

- Geopolitical and Economic Shifts: Major geopolitical events, economic crises, or unforeseen environmental changes could significantly impact global trade and air cargo demand, affecting ATSG’s performance.

FAQs.

What is the Air Transport Services Group (ATSG) stock prediction for 2025?

Based on historical data and trends, our forecast suggests that the ATSG stock price in 2025 will be approximately $15.20. This projection takes into account the average growth rate observed over the past 10 years.

Keep in mind that stock predictions are subject to various factors, including market conditions, company performance, and external events. Investors should always exercise caution and conduct thorough research before making any investment decisionsWhat is the Air Transport Services Group (ATSG) stock forecast?

Short-Term Forecast (Tomorrow):

The ATSG stock is expected to reach $12.95 tomorrow, which would represent a 0.30% gain compared to the current price.

This short-term prediction is based on market trends and immediate factors influencing the stock.

Mid-Term Forecast (Next Week):

Over the next week, the price of ATSG is projected to increase by 2.81% and reach $12.80.

Investors should keep an eye on any news or developments related to the company during this period.

Long-Term Forecast (Based on 10-Year Average Growth):

These predictions consider the historical growth patterns of ATSG over the past decade.

Keep in mind that long-term forecasts are subject to various factors and can change over time.

Here are the long-term predictions:1-Year Forecast (2025): $12.74 (-9.16% from the current price)

5-Year Forecast (2025): $15.27 (10.39% growth)

10-Year Forecast (2030): $25.40 (80.97% growth)

Remember that stock forecasts are based on various assumptions, including market conditions, company performance, and external factors. Always consult with a financial advisor and conduct your own research before making investment decisions. 📈💼What is the target price for ATSG?

Current Stock Price (As of April 30, 2024):

The ATSG stock closed at $12.82 on April 30, 20241.

Short-Term Price Targets (12-Month Forecast):

Six analysts provide 12-month price forecasts for ATSG.

The average target price is $22.83, with a low estimate of $14 and a high estimate of $28.

This implies a potential increase of 75.21% from the current stock price of $13.032.

Long-Term Price Targets (2025 Forecast):

The average twelve-month prediction for ATSG is $23.33.

The high price target is $30.00, while the low price target is $14.003.

Additional Insights:

Based on short-term price targets, the average forecast for ATSG is $20.67.

The range of forecasts spans from $14.00 to $27.00.

On average, this represents a 60.61% increase from the last closing price of $12.8Who are the shareholders of ATSG?

Major Institutional Holders:

Amazon.com, Inc. holds approximately 12.74 million shares (19.40% of outstanding shares) as of December 31, 2023.

River Road Asset Management, LLC owns around 7.02 million shares (10.69% of outstanding shares) as of March 31, 2024.

Vanguard Group Inc holds approximately 6.06 million shares (9.22% of outstanding shares) as of December 31, 2023.

Top Mutual Fund Holders:

The Vanguard Total Stock Market Index Fund holds approximately 2.06 million shares (3.13% of outstanding shares) as of December 31, 2023.

The U.S. Global Jets ETF (JETS) owns around 1.98 million shares (3.02% of outstanding shares) as of December 31, 2023.

Individual Shareholder:

Willem Mesdag is the largest individual shareholder, owning 29.33 million shares, which represents 44.65% of the company2.Will Air Transport Services Group stock reach $100?

Air Transport Services Group (ATSG) Stock Price:

As of April 30, 2024, the closing price for ATSG stock was $12.821.

The stock has been analyzed by various experts, and they have different price forecasts:The average 12-month price target for ATSG stock is $22.83, with a low estimate of $14 and a high estimate of $28. This suggests an expected increase of approximately 75.21% from the current stock price of $13.032.

Another source indicates that the average twelve-month price prediction for ATSG is $23.33, with a high price target of $30.00 and a low price target of $14.003.

It’s important to note that the current stock price is significantly below the $100 mark mentioned in your query.

Stock Forecast and Growth:

ATSG is forecasted to grow its earnings and revenue by 2.9% and 0.8% per annum, respectively. Additionally, the earnings per share (EPS) is expected to grow by 14.6% per annum. However, the return on equity is forecasted to be 3.5% in the next 3 years4.

Conclusion:

Based on the available data, it’s unlikely that ATSG stock will reach $100. The highest expected price by August 17, 2024, is $14.54 according to the algorithmic estimates1.

Investors should consider these forecasts and other relevant factors when making investment decisions.What are the ATSG Stock Earnings: Air Transport Services Gr Beats EPS, Misses Revenue for Q1 2024.

Earnings per Share (EPS): ATSG reported earnings per share of 16 cents, surpassing the analyst estimate of 10 cents1.

Revenue: The company’s revenue for Q1 2024 was $485.52 million, which fell short of the analyst estimate of $497.52 million by 2.41%1.

Additionally, ATSG recently announced agreements with Amazon.com Services LLC to operate ten additional Boeing 767 freighters by the end of 2024 and extend their commercial flying agreement until May 2029. The agreement includes mutual extension rights for five additional years and an award of 2.9 million warrants to purchase ATSG common shares for Amazon2.

These results highlight ATSG’s performance in a challenging market, emphasizing safe operations, customer satisfaction, cost control, and disciplined capital allocation. The company aims to generate positive cash flow in 2024, having already achieved $15 million in Free Cash Flow during the first quarter2.